4 Simple Techniques For Hsmb Advisory Llc

Table of ContentsNot known Details About Hsmb Advisory Llc Hsmb Advisory Llc - QuestionsHsmb Advisory Llc - QuestionsThe Main Principles Of Hsmb Advisory Llc Some Known Facts About Hsmb Advisory Llc.Excitement About Hsmb Advisory Llc

Ford states to avoid "cash worth or permanent" life insurance policy, which is even more of a financial investment than an insurance policy. "Those are very made complex, included high payments, and 9 out of 10 people do not need them. They're oversold since insurance agents make the largest compensations on these," he claims.

Handicap insurance policy can be costly. And for those that decide for long-lasting care insurance policy, this policy might make disability insurance unnecessary.

Things about Hsmb Advisory Llc

If you have a persistent health and wellness issue, this kind of insurance coverage can wind up being critical (Life Insurance). Do not let it stress you or your bank account early in lifeit's typically best to take out a plan in your 50s or 60s with the expectancy that you won't be using it until your 70s or later on.

If you're a small-business owner, consider securing your source of income by acquiring company insurance policy. In the event of a disaster-related closure or period of rebuilding, business insurance policy can cover your revenue loss. Consider if a substantial weather event influenced your store front or manufacturing facilityhow would that affect your revenue?

And also, utilizing insurance policy can in some cases cost greater than it saves in the future. As an example, if you obtain a chip in your windshield, you may think about covering the repair service expenditure with your emergency cost savings as opposed to your automobile insurance coverage. Why? Due to the fact that using your auto insurance coverage can cause your monthly premium to go up.

The Buzz on Hsmb Advisory Llc

Share these pointers to safeguard enjoyed ones from being both underinsured and overinsuredand consult with a relied on professional when needed. (https://www.gaiaonline.com/profiles/hsmbadvisory/46584207/)

Insurance coverage that is purchased by an individual for single-person coverage or insurance coverage of a family members. The private pays the premium, as opposed to employer-based medical insurance where the employer usually pays a share of the costs. People may look for and purchase insurance coverage from any plans available in the individual's geographical area.

People and households may get economic assistance to reduce the cost of insurance costs and out-of-pocket costs, yet only when registering through Connect for Health And Wellness Colorado. If you experience particular changes in your life,, you are eligible for a 60-day time period where you can sign up in a private plan, also if it is outside of the yearly open registration duration of Nov.

The Best Strategy To Use For Hsmb Advisory Llc

- Link for Health Colorado has a complete list of these Qualifying Life Events. Reliant children who are under age 26 are qualified to be consisted of as member of the family under a parent's insurance coverage.

It might appear basic yet understanding insurance coverage kinds can additionally be confusing. Much of this confusion comes from the insurance policy sector's continuous objective to make customized insurance coverage for policyholders. In developing versatile policies, there are a range to select fromand all of those insurance coverage types can make it hard to recognize what a specific policy is and does.The Single Strategy To Use For Hsmb Advisory Llc

If you die throughout this duration, the person or individuals you've named as beneficiaries may get the cash money payout of the policy.

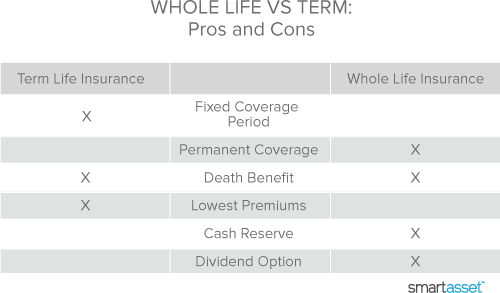

Several term life insurance policy policies allow you convert them to a whole life insurance policy, so you do not shed coverage. Normally, term life insurance policy plan premium settlements (what you pay per month or year into your plan) are not secured in at the time of purchase, so every 5 or 10 years you own the policy, your costs can climb.

They also have a tendency to be cheaper general than whole life, unless you purchase a whole life insurance coverage policy when you're young. There are likewise a browse around here couple of variants on term life insurance coverage. One, called team term life insurance policy, prevails among insurance coverage options you could have access to with your employer.The Buzz on Hsmb Advisory Llc

One more variation that you may have access to with your company is extra life insurance coverage., or burial insuranceadditional coverage that can aid your household in situation something unforeseen takes place to you.

Irreversible life insurance coverage simply refers to any life insurance coverage policy that doesn't expire.